FINANCE

ARGYLE Haus Supports Emerging Brands With Incubator Launch

By Dorothy Crouch, Contributing Writer | October 3, 2025

Los Angeles–headquartered design house and manufacturer ARGYLE Haus of Apparel has launched its Fashion Incubator as a program that provides comprehensive domestic planning, development, production and promotion for emerging brands.

What’s Trending in the Apparel Sector? As It Turns Out, Beauty Isn’t Just Skin Deep

As 2024 picks up steam, consumer habits that came to the forefront during the holiday shopping season continue to manifest.

What the Apparel Industry Should Know to Navigate Some Choppy Seas

The California Apparel News recently checked in with Robert Krieger, president of logistics company Krieger Worldwide—“a kind of travel agent for cargo,” as he puts it—to give us the outlook on shipping as it relates to the apparel industry and the challenges that lie ahead.

A Shipping Tipping Point

2024 is starting off with a bang. The daily attacks on ships in the Red Sea, the most severe drought in the history of the Panama Canal, the looming expiration of the East and Gulf Coast ports...

Fashion Seeks Financial Relief From the Fed in 2024

California Apparel News asked industry leaders: When thinking about the potential for the Federal Reserve to cut rates in 2024, thereby moving inflation closer to the agency’s 2 percent goal, what does this mean for the fashion industry?

WOCF Closes $25M Deal With Cold-Weather Apparel Company

White Oak Global Advisors is a leading alternative debt manager specializing in originating and providing financing solutions to support small and middle-market enterprises at every stage of their life cycle...

Los Angeles’ Major Shopping Destinations Welcome the Winter Holidays

Many of Los Angeles’ most popular retail centers held events throughout November to mark the beginning of the 2023 holiday season...

NRF Releases Initial Thanksgiving Holiday Shopping Report

From phenomenal to lackluster, retailers recount differing experiences over the long Thanksgiving shopping weekend. That’s where the National Retail Federation steps in with big-picture stats and numbers that put everything in perspective.

An Opportunity for Greater Opportunity Around the World—Through Smart Trade

For the past decade in particular, U.S. apparel and footwear companies have been intensely focused on sourcing diversification. As U.S.-China and related geopolitical tensions increase, the momentum is even stronger...

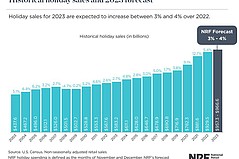

NRF Forecasts Consumer Holiday Spending to Exceed $957B

The National Retail Federation forecasted 2023 consumer holiday retail spending will reach between $957.3 billion and $966.6 billion, reflecting 3 to 4 percent growth over 2022.

UCLA’s Anderson Forecast Delivers Good News

Nothing’s more welcomed these days than surprise good news. And that’s what came in the latest UCLA Anderson Forecast—the prominent economic report put out by the University of California Los Angeles’ Anderson School of Management—which is cheerfully titled, “The Unexpected Robust Economy.”

Inventory Doesn’t Age Like Fine Wine and Other Financial Wisdom

Fashion never stands still—in fact, nothing in the world does. And the best-designed garments sitting in a warehouse are like flowers blooming where they can’t be seen, their life cycle fading in the dark.

Gap Inc. Appoints Chris Blakeslee as Athleta President and CEO

Gap Inc. has chosen Chris Blakeslee to lead its Athleta brand as the label’s next president and CEO, an appointment that is effective Aug. 7.

Taking Eco Transparency Into Account When Considering Financing

Ecological and ethical influences have reached every area of fashion and apparel. Abiding by greener apparel guidelines requires brands to remain transparent by revealing each step...

Port of L.A. Receives Infusion of Grants for Infrastructure Upgrades

Supply-chain woes may disappear like last year’s fashions thanks to a grant injection from state government to improve the Port of Los Angeles...

ITA’s Fashion ‘Road Show’ to Culminate in Dallas

“Spaghetti Western” is a term for low-budget cowboy movies made in Italy 50 years ago—several of which became cinematic classics—and now Italy and Texas are joining forces...